Portfolio Management

Service (PMS)

Grow your wealth with expert-led

Portfolio Management Service (PMS)

Portfolio Management Services (PMS)

PNC Wealth's Portfolio Management Services (PMS) offer a personalized approach to investing, designed to help you achieve your unique financial goals. Our experienced professionals take the reins, crafting and actively managing your investment portfolio based on your:

Risk Tolerance

Are you comfortable with higher potential returns alongside greater risk, or do you prioritize capital preservation?

Investment Objectives

Are you saving for retirement, a child's education, or a dream vacation?

Financial Timeline

When do you expect to need access to your invested funds?

Benefits of PINC Portfolio Management Services (PMS)

Who is PINC PMS right for?

PINC PMS is ideal for investors who

- Desire a hands-off approach to investing while benefiting from professional expertise.

- Seek a personalized portfolio tailored to their risk tolerance and investment objectives.

- Have specific financial goals they want to achieve through strategic investing.

- Appreciate the value of ongoing professional guidance and portfolio management.

CLAP your way to wealth

Competitive Advantage

- Cost leadership & pricing power

- Wide distribution network

Low-Debt

- Ability to generate healthy free cash flow

- Fund significant capex through internal accruals rather than massive debt

Addressable Market

- Companies with a substantial market growth

- Companies gaining market share from their competitors

Promoter Quality

- Strong corporate governance practices

- Track record of execution

How we Shortlist Stocks?

Addressable Market Size

Large addressable markets with a dominant market presence

Global Industry Cues

Global market size vs Indian market size

Managerial Expertise

Management vision and credibility along with strong commitment to corporate governance

Sector Tailwind

Favorable growth drivers in the industry

Business Model

Robust and resistant to changes in the environment, scale up potential organically

Free Cash Flows

Ability to generate free cash flow

Growth Strategy

Market penetration, product development, market development & diversification

Key Competitive Advantage

Pricing power, Cost leadership, Brand loyalty, Backward & Forward Integration etc

Capital Allocation

Increasing return ratios with RoE and RoCE above cost of capital

Investment Screening Strategy

Financial Evaluation

- Scalable business model with strong earning visibility

- Operating cycle of last 3-5 years

- Free cash flow growth of the last 3-5 years

- Capex through internal accruals/ minimal debt

Management Evaluation

- Annual report analysis (Auditors, remuneration data, related party transaction etc)

- Forensic accounting evaluation

- Guidance vs delivery - Past track record of business execution

- Shareholding pattern & pledge history

Risk Management

- We are not believers of BAAP (buy at any price) rather we wait for the shortlisted companies to come to the price which offers a relative valuation comfort

- We avoid high allocation in cyclical sector as prices and realizations changes are based on external factors

- We track the shortlisted investment portfolio on a quarterly performance basis

- Companies with promoter pledge less than 20% are preferred

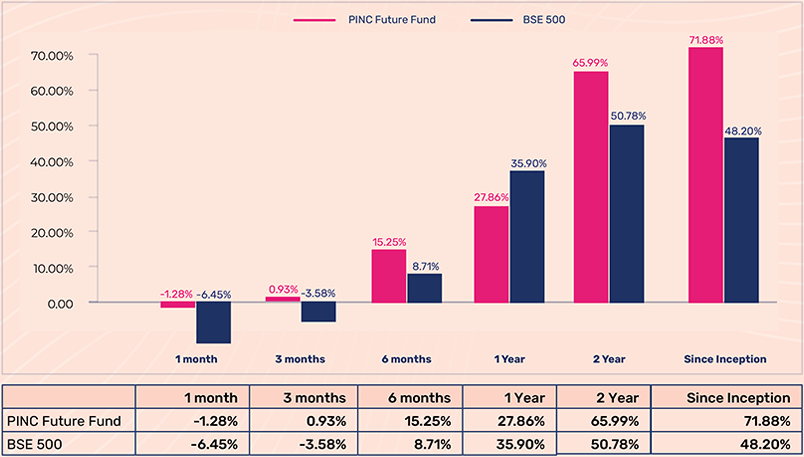

PINC Future Fund

Portfolio Performance

As on 31 October 2024

As on 31 October 2024

We're here to help.

Related Articles

AskPINCWealth, your bite-sized guide to smarter investing!

In this episode, we’re answering your top questions- how many stocks to hold, what to do when markets dip, and why we don’t rebalance too often.Simple tips, practical advice, and long-term focus, just what you need to build wealth the smart way.

Know more

How monsoon affects the Indian stock market: what investors should do?

Exploring how monsoon influences the Indian stock market, the most profitable sectors, historical trends, and strategies for investors to navigate through market volatility.

Know more

How to analyze a Smallcase before you invest-: A checklist for smart investors

This is a quick guide for investors to evaluate a Smallcase portfolio, covering stock selection logic, factsheet analysis, red flags, and more to help you invest with clarity.

Know more

Is India’s grid ready for the EV boom? A smart investor's guide

The adoption of EVs in India is rapidly growing and has a promising future, but the million-dollar question is whether the power is ready to accommodate this or not.In this article, we break down what’s happening

Know moreMeet the people

we served!

PINC Compounder Smallcase has simplified my investment journey. Seriously, investing has never been easy for me! Here in a single click, I could access a balanced portfolio. Thanks PINC.

Mr. Akhilesh

I was hesitant about investing, but PINC Smallcase changed that. Talking to their team and looking at their growth gave me confidence. I've seen my investments grow steadily since then. I'm impressed!

Devendra Palan

As someone with limited knowledge about the stock market, I found Pinc smallcase to be a reliable and accessible platform. Their detailed reports and analysis have given me a deeper understanding of the stocks in my portfolio. I feel confident in managing my investments.

Pratik Gandhi

Subscribe to our email list

Sign up for Expert Insights

Your Gateway to Smarter Wealth

Management!